|

|

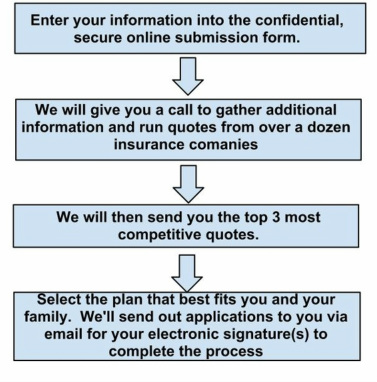

The Equine Insurance Process

|

Horse Insurance ExplainedOwning a horse is as much a financial investment as it is an emotional one, and there are serious realities to consider. What if you own more than one horse? Should you insure every horse in your barn? If your horse dies, will you be able to afford another? Or should you consider an insurance policy to help offset the cost of replacing your horse? Speaking from personal experience, I have not insured any of my horses, past or present. The decision was not a lack of love for my horses, but an economical one. For me, a college student with a few moderately valuable horses, the replacement cost is actually The benifits of equine insurance can easily outweigh the expense, especially if your horse ever needs major medical care.lower than purchasing an annual insurance policy for each horse. However, my neighbor, Peggy Cropsey, owner of Windsor Farms, chooses to insure some, but not all of her horses. “Benjamin, the horse I use for international combined driving events, is covered in case he is injured during competition or while we are traveling,” Peggy explains. “I also insure Shaymen, my Welsh Cob stallion, because of the financial investment made when I bought him. “Also,” she continues, “this year I leased two broodmares, Tia and Gracie. I had to purchase insurance for Gracie as part of the lease agreement, and Tia came to my farm with insurance coverage.”

Policies Available

Most equine insurance companies have two basic types of coverage, while some might offer three. The two most common policies are full

mortality and specified perils, also called limited risk. “ Choosing an insurance policy is an important economic decision,” explains Rhonda Mack, an insurance agent who has 12 years of experience with Jerry Parks Insurance Group in Ocala, Florida. Full Mortality covers death as a result of accident, sickness or disease. This is the broadest type of equine insurance and includes external and internal causes of death. Full mortality coverage also includes items specified under perils insurance and special accident policies. Because of the extensive coverage, this is the most expensive type of insurance. Perils Insurance covers death as a result of fire, lightning, shipping and other causes explicitly outlined in the policy. This is the least expensive coverage because it only covers your horse for particular instances clearly stated in the policy. Your bill for a $50,000 broodmare covered by perils insurance would cost about 0.5 percent, or $250 a year. Special Accident is the third type of coverage offered by some companies. Special accident policies cover death as a result of any external and visible accidents. This policy is less expensive than mortality coverage,

but costs more than perils insurance because it includes external accidents and specified perils. However, it still excludes any internal factors.

Horse Insurance Experts covers horses in large stables, on farms and at racetracks all over the United States and Canada. After working in the equine insurance business for more than a decade, Rhonda Mack can recall situations where insurance coverage would have been helpful. “One farm experienced a barn fire, which killed 22 horses and only one was insured,” she explains. “We have also had multiple horses die from one lightning strike.” This situation can happen when several horses stand near each other under the same tree that is struck. With all the summer thunderstorms in the South, death by lightening is, unfortunately, not uncommon.

If you purchase a full mortality policy, consider adding major medical, surgical or loss of use coverage. Major medical insurance covers unexpected medical and surgical procedures resulting from accident, illness or disease that occur within the paid policy period. Medical coverage does not pay for routine expenses, such as vaccinations, castration, farrier bills or dental needs. Most medical policies have a $250 deductible per claim. The insurance company will reimburse the insured for covered medical expenses up to the policy limit, less the $250 deductible. In the event your horse needs emergency medical treatment, you can visit an animal clinic or call a veterinarian to the barn without fear of an astronomical veterinary bill. Depending on the veterinarian or animal hospital, a deposit or credit card payment might be required at the time of treatment, but the insurance company will reimburse you for the covered costs. Racehorses are not eligible for major medical coverage, due to the high-risk nature of their careers. Steeplechase horses are classified with traditional racehorses and are also ineligible for major medical coverage. Loss of use insurance is only available for horses used in certain disciplines and has minimum age and value restrictions. For example, one insurance company will extend loss of use insurance to horses used in dressage, hunter/jumper competitions, reining and cutting events. Another company might cover horses used in the above disciplines and Quarter Horses used for western pleasure and barrels. However, pleasure/trail horses and racehorses are ineligible for loss of use coverage. Loss of use insurance is written so that a percentage of the horse’s value is paid to the owner if an injury/illness leaves a horse permanently unable to perform its discipline (as stated on the policy). Once a loss of use policy has been paid, some companies have the right to take possession of the horse. Others might offer a lower reimbursement if the owner chooses to keep the horse. Major medical insurance must be purchased with loss of use coverage. A veterinary exam, radiographs and flexion tests on all four legs are required for loss of use insurance. Stallion infertility coverage is divided into two categories. One is 60 percent congenital infertility, which is normally sold as a package with mortality, and accident, sickness and disease (AS&D). Congenital infertility is usually purchased for expensive thoroughbred stallions during the first season they are at stud. This policy will pay if the stallion does not succeed in impregnating 60 percent of eligible mares. The policy specifies a set maximum and minimum number of mares for breeding. Additionally, the mare’s age and foaling history are also taken into account. Congenital infertility policies include extensive applications, veterinarian exams and are quoted on a case-by-case basis. It is always best to speak with your insurance agent for specific details.

“CIGAR (the legendary Thoroughbred racehorse) is an example where a congenital infertility claim was paid,” Rhonda Mack says. “When I visited the Kentucky Horse Park in November 2003, the staff explained that he was unable to get 60 percent of the mares he bred to in foal and that a stallion infertility claim had been paid. He is currently owned by the insurance company and is at the Kentucky Horse Park. The company tests CIGAR each year to see if he has become more fertile in hopes of recouping some of its investment, but to date he is still infertile.” In addition to mortality, accident, sickness and disease (AS&D) infertility coverage is available for breeding stallions. Usually the rate is 0.5 percent.

AS&D coverage pays if a stallion becomes permanently infertile due accident, sickness or disease, but does not pay if the cause is congenital (that is covered by the previously discussed policy).

Determining Insurable Value

“ A horse’s insurable value is based on several factors, which include age, discipline and performance record,” Rhonda says. For a foal, the initial figure is based on twice the amount of the stud fee. If any siblings out of the same DAM have performed or sold well, the value could be adjusted accordingly. Foals as young as 24 hours old are eligible for insurance coverage. A horse is also evaluated based on its original purchase price, show record and training. The original purchase price, proved by a bill of sale, is used to generate a base figure. From there, a thoroughly documented show record, including points from accredited shows/associations can increase the value. A portion of training expenses can be included in the total worth of the insured horse. An appraisal is not typically used to determine a show horse’s worth because values can vary greatly between appraisers. Routine care costs, such as veterinarian bills, farrier work and board fees, do not contribute to determining the value of the horse.

“It can get confusing, especially if a horse is traded for another horse or other merchandise,” Rhonda explains. “Someone may trade a Porsche or a trailer for a horse. In this case, the insurance agent, with the help of the insured, must research the values of the items in the trade to decide what the new horse is worth,” Rhonda says.

Cost to Insure

The annual cost to insure your horse will depend on its age, breed, use and determined value. Most companies rate a dressage horse between 3 and 14 years of age at 3 percent. If the horse is worth $10,000, mortality coverage will cost $300 per year. Steeplechase horses insured for mortality have a minimum mortality rate of 9 percent, so a steeplechaser worth $10,000 will cost about $900 a year to insure for mortality. Rates vary by company; therefore it is always best to check with your agent for

specific figures.

Non-insurable Horses?

While many companies insure horses as young as 24 hours old up through 18-20 years of age, there is such a thing as an “uninsurable horse.” For example, horses with multiple health problems or those identified as having Hyperkalemic Periodic Paralysis disease (HYPP) with an H/H test result will not be covered. HYPP is a muscular disease that can cause paralysis and sudden death, and H/H horses are affected homozygote carriers of the disease, thus making the horse uninsurable.

Limitations/Exclusions

When buying automobile insurance, car owners choose the specific coverage they want, such as collision, full or partial glass, etc.

Equine insurance companies can choose to insure a horse for 100 percent of its value without limitations, or they might place limitations, known as “exclusions,” on the policy. Exclusions can include pre-existing medical conditions, such as colic and chronic degenerative complications such as laminitis. Some of these exclusions are only temporary. After a set “trial period,” the company can re-issue coverage if there has not been a recurrence during the designated time. On the other hand, diseases that have chronic flare-ups can qualify as permanent exclusions. In these cases, mortality and major medical are still available, but the chronic condition is excluded from coverage. For example, if your pony is in great shape but has had several bouts with colic recently, his insurance policy

might exclude colic surgery.

Required Insurance

Many times boarding stables will require clients/boarders to purchase insurance. This is crucial if the caretaker must treat a medical emergency during an owner’s absence. The stable owner has peace of mind knowing that he or she can provide optimal medical care without worrying about how the procedures will be paid for.

Another scenario:

If the horse has been purchased with a loan, the lending bank might require the owners to buy an insurance policy. Deciding to insure a horse, even if the original purchase price of the horse is not a huge investment, relieves horse owners of financial concerns in the time of a medical emergency. Rhonda Mack recalls a situation where a couple owned a pleasure horse worth about $4,000. Because of the relatively inexpensive initial cost of the horse, the couple chose not to insure the horse. When the horse had an episode of colic, however, the owners asked their veterinarian to try every procedure other than surgery because they were concerned that surgery would be very costly. After 4-5 days of treatment, the horse died, and the owner’s bills totaled more than the cost of an annual insurance premium. Had the couple purchased a policy, the surgical costs would have been covered, and the horse might have lived.